We have another round of Instagram Updates to discuss! They are on a roll this year! Please make sure to watch the video to follow along for tutorials.

Why Instagram Marketing?

The better question may be why marketing, period.

Here’s the God honest truth – you could have the best product in the world but if nobody knows who you are it really doesn’t matter. So for this reason, as a business owner, you should be taking marketing including any Instagram algorithm updates seriously.

Let me share some behind the scenes of what’s been going on in my business over the years to help illustrate a point.

Marketing and sales training is actually my second business. In my first business I was a full-time content marketer who specialized in financial content. In that business, I focused on social media quite a bit and actually amassed quite the following. Nearly 40,000 followers on Twitter, over 30,000 on Instagram, nearly 10,000 on LinkedIn and over 10,000 between my Facebook assets.

In other words, I know a thing or two.

That being said, I ran into a major problem in my second business. That problem was that while I’d amassed a big social media following throughout the years, I had pretty much zero backend systems or processes. You can ask my core team who has been with me for nearly four years, it was a freaking mess. Quite frankly, I didn’t need funnels and systems in the first business so I didn’t have any.

So I spent 2019, 2020 and 2021 getting clear on systems, processes and team. Made a lot of mistakes, lost money, made a lot of money, took way longer than I thought it would and ran into several challenges but in the second quarter of 2022, it was all finally complete.

That means marketing was put on the backburner for a few years. I outsourced some of it, got some help here and there, but it was never quite right or what I envisioned as the CEO.

Now as we head into Q3 of 2022, I’m taking the reigns of my marketing again – starting with Instagram and YouTube. Back like I used to do in my first blog, as soon as I learn something and start implementing it, I’m going to share what I’m learning.

Instagram is moving toward being a video platform.

This is not a new Instagram algorithm change, but they did make it a point to reiterate it again. Instagram is focusing heavily on moving toward being a video platform, hence they are pushing reels out.

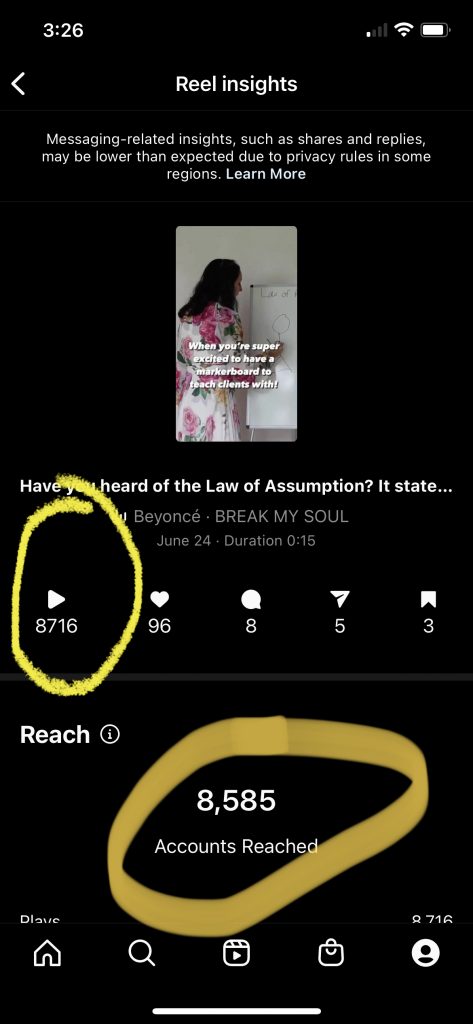

And let me tell you, you can get new eyeballs on you quickly with Instagram Reels. I posted a Reel on Friday that got 8,000 views in an hour. If you have not tried Instagram Reels yet I highly suggest that you do. They are fun, can get a lot of results quickly and they get pushed out to newer audiences so you are in front of new potential leads.

A Hack for Static Posts

If you’ve posted a static photo on Instagram in the last few months then you may have noticed it barely gets any reach. It’s abysmal. Fortunately, there is a hack to reuse some popular static post ideas – such as quote graphics – and turning them into Reels. Make sure to follow along with the video above to see the full tutorial.

Step 1: Find one of your quotes. Perhaps it was a Tweet you sent out that’s really good. Take a screenshot of it and load up to your Canva account.

Step 2: Find a royalty-free video from a place like Pixabay or Pexels that you can use as the background and upload to Canva.

Step 3: Look for “Instagram Story Video” on Canva and start with a blank canvas.

Step 4: Add the video to the background and your quote to the foreground. Once you like the image, download it to your phone.

Step 5: Open your Instagram account, select Reels, grab the Reel you just made from the gallery.

Step 6: Add trending music.

Step 7: Create a caption (remember Instagram is turning into a search engine now too so put in those keywords), find the appropriate hashtags and post.

Pinned Posts

Instagram is now allowing you to pin posts to the top of your feed. I got this great tip from Vanessa Lau on how to best utlizie this new feature. Make a Reel introducing yourself and all the free resources you have available for people. Prompt them to follow you, turn on notifications and add you to their favorites. Pin it as your first post.

If you’re taking advantage of the new Instagram updates then chances are you will be focusing on Reels. If you’re focusing on Reels then you know they get pushed out to new audiences. If they get pushed out to new audiences, then you’ll want a video introducing yourself and prompting people to follow you.

Creator’s Studio Instagram Updates

Instagram has made one update to the Creator’s Studio that I love. You can now see all of your Facebook Business Page and Instagram direct messages in one place. This is fantastic for my team who is the DMs every day talking to potential clients.

I don’t know about you, but there was a time when I was overwhelmed by all the messages. I simply couldn’t get to them. This is terrible for sales. Now that they are all in one place, it’s easier for leads not to fall through the cracks.

Who Will Benefit Most From Instagram Updates

The people who will benefit most from the new Instagram updates will be people who create original content for the platform. That means resharing other people’s content or reposting from other platforms isn’t really going to work with the algorithm changes.

Instagram’s reasoning for this makes sense. Essentially, they believe that if you put in the work, you should be the one to benefit most from the algorithm. It sounds fair to me.

What this means for businesses?

This means it’s time to get your creative innovative hat on! I believe these Instagram updates present a fabulous opportunity for us to connect with our audiences in a new way. That’s why I’m excited to be able to put my marketing hat back on in the business. I hope you’ll follow me along for all the updates.